Once inflation went high then even soft landing will show us tough time, but it won’t last long as it does for recession. What are possibilities of recession, if we look at past? There are questions beucase soft landing was only done once.

Currently everyone is wondering that is there any possibility of soft landing because many of us do not want to see a recession. So, have a look at that is it even possible?

First let’s see why people are even thinking about soft landing.

Why soft landing?

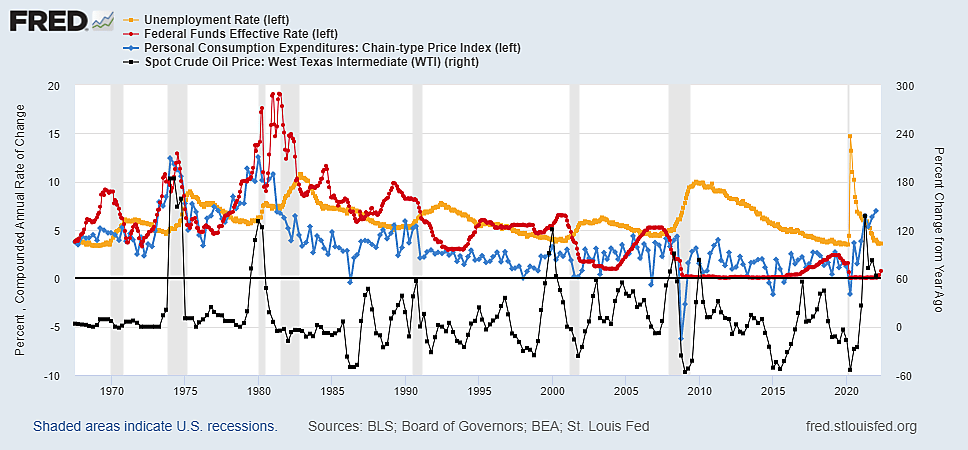

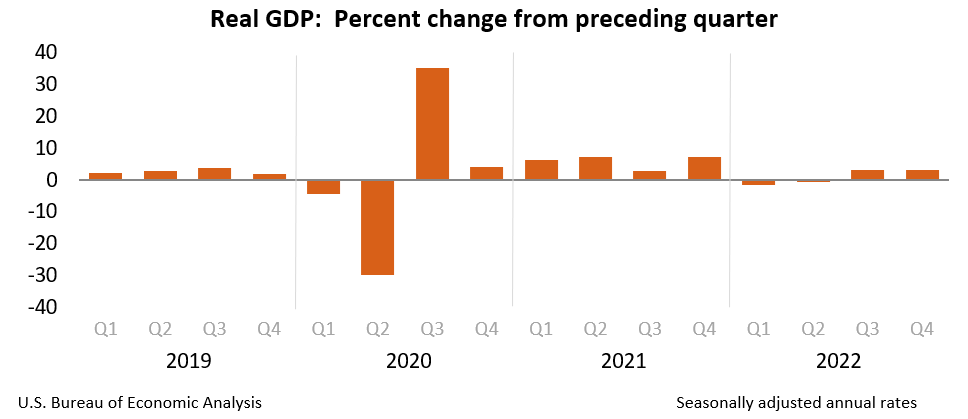

Inflation hit the 40-year record high, and people were worried about economic downturn aka recession. There were so many articles released as recession in 2022 will be biggest crash in history and it will take more than a decade to recover from it. But because of government increasing in interest rates, now recession is pushed in 2023.

Because of such high fear in people’s mind, they all were worried about recession. Inflation wat at its peak at 9.1% (according to government) but in actual world it was at 17%. Government only calculates things on paper but in practical world, it has big difference, read this: https://hninstructing.com/inflation-is-now-at-its-peak/

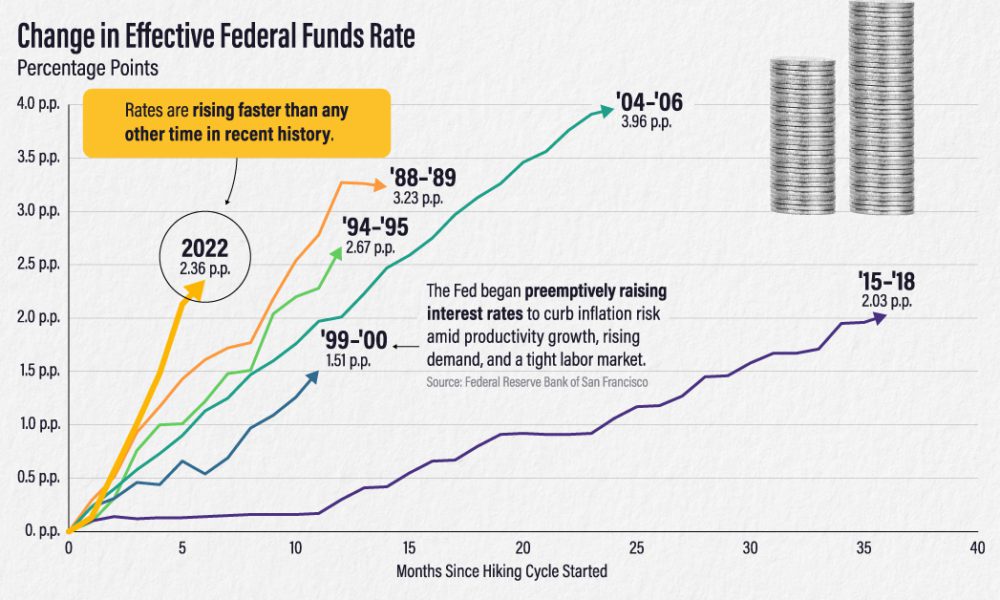

In 2022, inflation was peaked and Fed was raising interest rates at a crazy rate. They raise interest rate quicker than ever in past even faster than ’88-’89. This was concerning and it made everyone scared. To control inflation fed increased interest rates, this caused money in market will be available at higher rate.

In 2023, inflation is coming down then why they are still rising interest rates.

Why still raise interest rates when inflation is down?

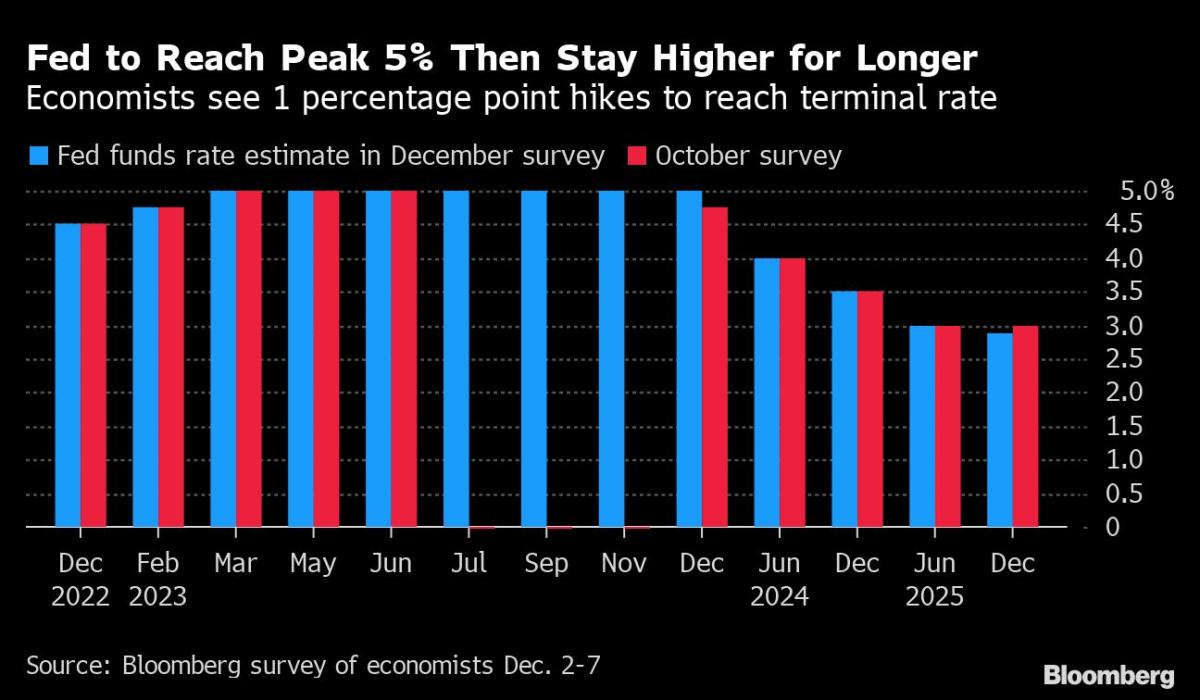

In economics, there is term as terminal interest rates. Terminal interest rates mean that when hike of interest rates get to a certain point then inflation starts to get lower by itself and for that they don’t have to do anything as print more money or take debt. Fed believes that terminal interest rate this time is 5.1%, but they can’t stop at 5.1% so they will do it at 5.25%. After they have increased interest rate to 5.25% then there will be no interest rate hikes. What economists believe is Fed will stop at 5% but truth is they will stop at 5.25%.

So, you might be wondering how long will it take to lower inflation after reaching to terminal interest rates? There is no specified period as after this many weeks or months of achieving terminal interest rates, inflation will go lower. After achieving terminal interest rates, it might take anywhere from months to a year to get inflation low. It might take mid ’24, too. So, rate hikes dates are 22nd March and 3rd May.

The question is there why they are looking for soft landing?

Why Fed wants soft landing?

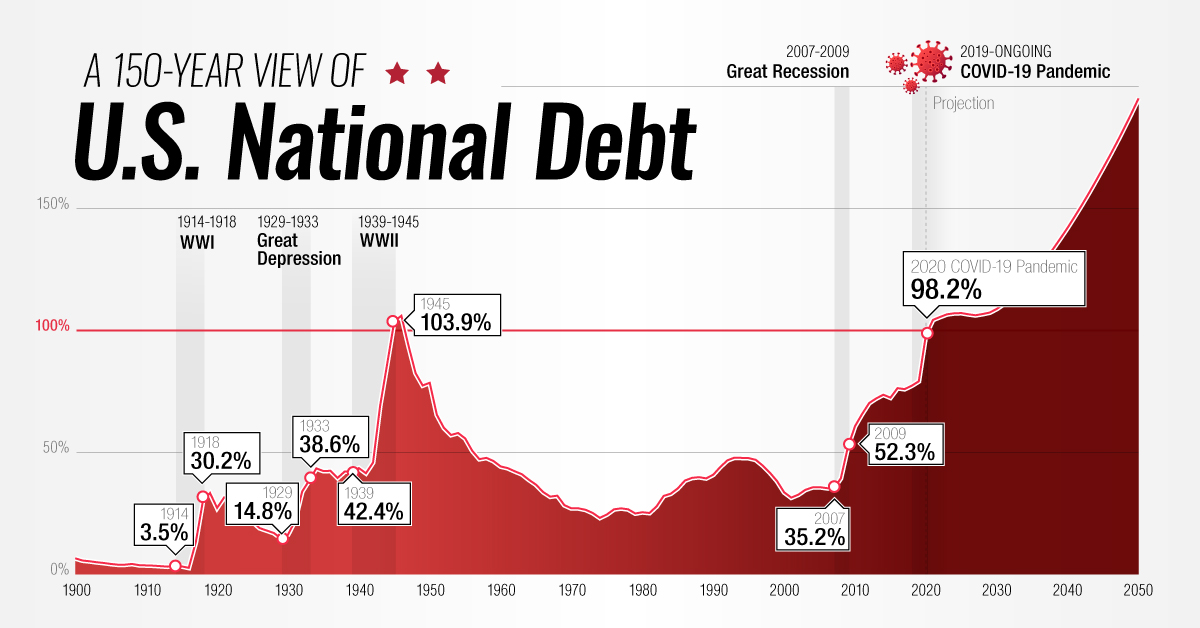

Everyone knows that they have hit new debt ceiling of $31 trillion and everyone is scared that recession is ahead. That gives negative impression to government and will be bad for 2024 elections. If they can do soft landing that this will make sure that they have strong stand in ’24 election. That’s why it became so important that they need to do soft landing.

Thay always say that this is new debt limit, and we will not hit new debt limit, this makes people to not trust on them and this affects their elections, too. They want that power, and this would not work like that.

Now, let’s see that soft landing is even possible.

What does history say?

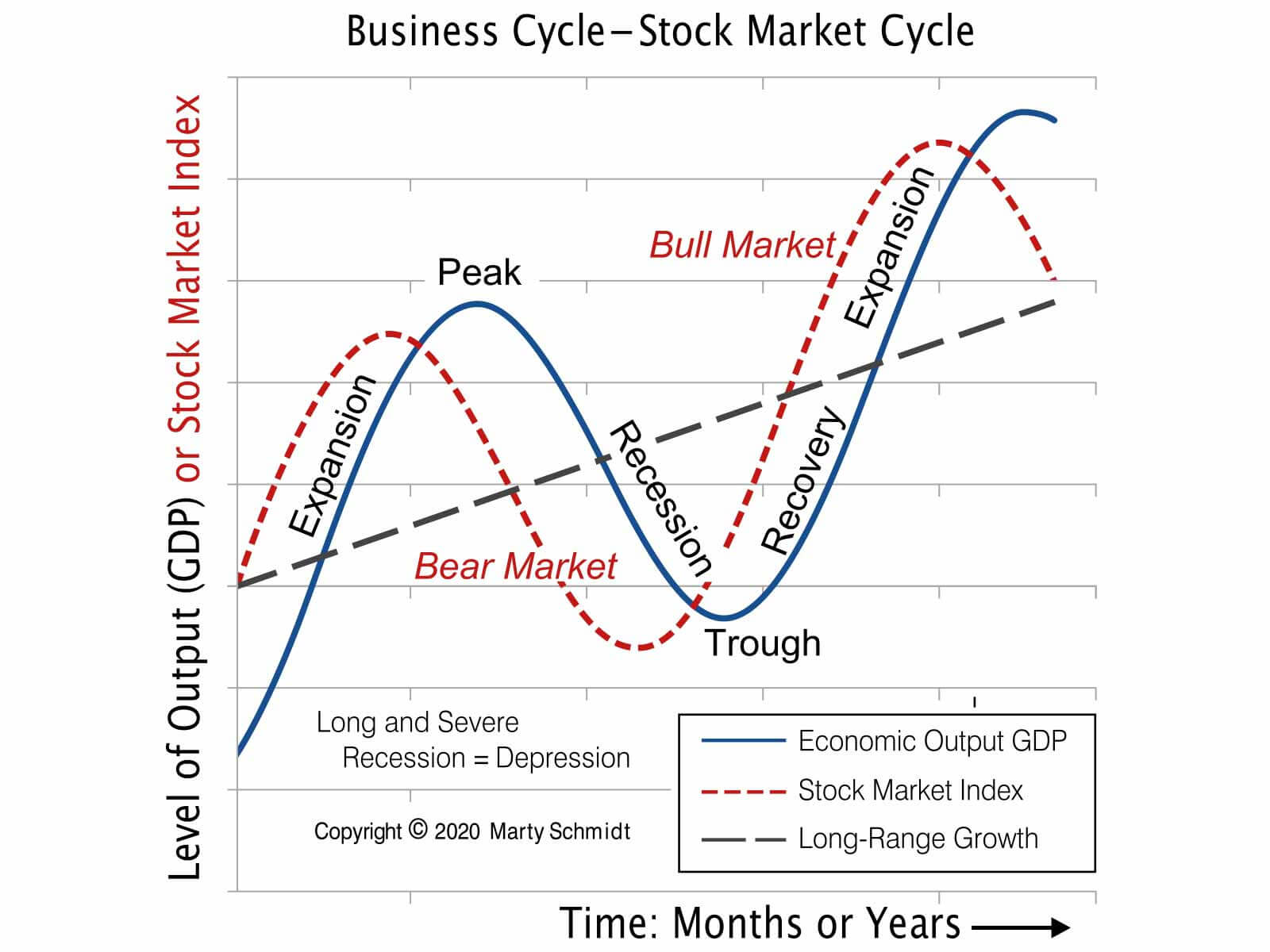

Before that, let’s have a broad look in past. There were so many recessions in past and we should have look at it, because history repeats itself.

Alan Greenspan was a great person who had idea that we can lower inflation without triggering recession and he successfully did it. And now this time, Jerome Powell thinks the same that he can lower inflation without a recession. Because soft landing has happened in past that’s why people have confidence that they can do it again, too. This is like a big experiment to an economy, and this will cause very bad consequences, if things go bad. I hope they don’t.

Is soft landing possible? then how will it look like?

Jerome Powell thinks as he can do soft landing in 2023-24. When interest rate gets at 5.25% then inflation will start getting lower. Once inflation gets below 2.1% then they will start lowering interest rates. Currently inflation is at 6.1% and this will take time to get at 2.1%. After getting inflation low enough then they will start lowering interest rates gradually.

What will happen to businesses?

Recession is tough phase for anyone no matter he is businessman or an employee. They all suffer. During recession there is not so many cash flowing in economy, and everyone is living in scarcity. During that time, cash is king. Whoever has cash will survive. It is so tough to grow or even sustain when people are holding on to cash and not able to get new clients.

So, recession is tough time for businesses. When soft landing will happen, and no recession will be triggered then there will be economic slowdown which will be similarly tough for businesses like recession. There is less cash in system so people hold on their cash, and it is so difficult to get new clients. There will not difference between soft landing and recession for businesses. They will only get new clients when recovery begins, and people have some cash which will be done when government pushes more (new) money in market aka system.

And what will happen to investors?

You guessed it correctly that recession is stressful phase to investors, too. Good investors hold on to money to buy best deals out there. If your business is heading towards bankruptcy and it is fundamentally strong then find investors. They will save your business and it will be worth it when economy starts recovering.

Now inflation is going up and interest rates are still rising. This is how exactly it felt like in March 2009.

During economic slowdown in soft landing, businesses struggle, and assets price go down, too. This will cause that there will be less cash flowing from assets to investors and they will need cash to survive. Assets prices are low, and investors have money then they find nice opportunity to invest in assets. this helps them to increase their portfolio.

Truth is soft landing won’t be beautiful. Everyone is saying that it will all rainbow and sunshine which is lie. There will be huge slowdown and we might even see three quarters with negative growth. This is truly bad sign for investors. We saw two negative quarters in 2022 and stock market went down.

What technical analysts say?

Stock traders and some investors do technical analysis. It is to time the market and sometimes they are right and sometimes they are wrong. This doesn’t mean that we can’t have a look at what they say. So, let’s see.

Even we see soft landing, we will have to face tough time and it is not risk free.

You don’t have to worry too much when you are financially free, grab your free guide on how you can become financially free: Guide on becoming financially independent for free – hninstructing.com

Want to learn more from me: Courses