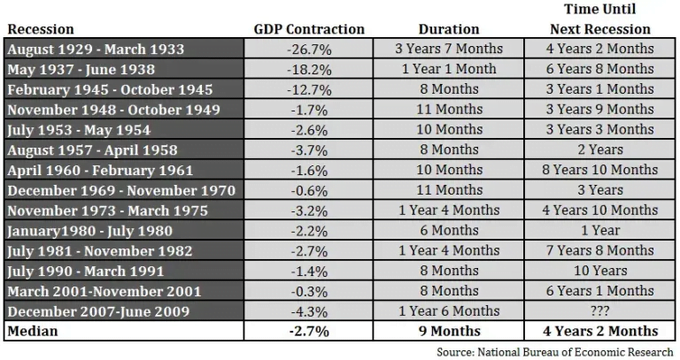

I have to say it to you that we are heading into recession. Recession is next. Even though Fed is saying that they will find way for soft landing but that is impossible now. I don’t mean that Jerome Powell can’t do like Alan Greenspan did in 1984. On an average it takes 8 months to figure out that we are in recession for government and its because there are so much lagging indicators.

This is time where there have been lot of bs that recession won’t come because there will be soft landing and I wrote that soft landing is not possible: Soft landing not possible. And I also said that 9.1% is inflation peak and after that, its going to come down even though actual inflation was near 17% and 9.1% was on paper, read here: Inflation is at peak. I think this recession is going to be biggest one: Heading towards biggest recession.

What is outcome?

The outcome will be long lasting because this could be biggest recession ever happen.

Unemployment factor

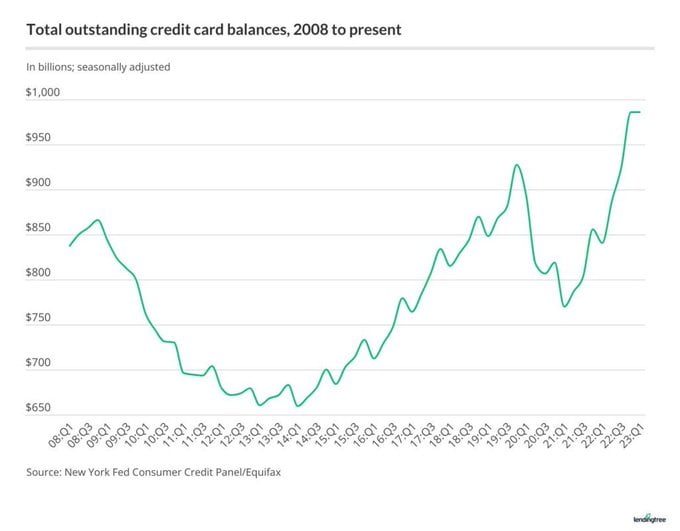

Its estimated that because Fed is increasing interest rate to 5.25%, 4 million people will lose their jobs. Already unemployment rate has went up from 3.4% to 5% and will rise up to 7%. US citizens are maxing out their credit cards to keep up with inflation and debt has gone up to $1 trillion.

But layoffs don’t stop here. There are more layoffs in recession that inflation. Companies try to hold on cash as much as possible from inflation to end of recession. First they try to cut down expenses as much as possible and then they start laying off people when they don’t have any way to save cash. Don’t think this is bad, it is because to keep company running.

So first is inflation and then recession, they have done everything they can to save money and hold on to cash but now only option they have left is layoffs and more layoffs will be seen in recession. If they default on their debt all of them then 8 million people will be unemployed and stock market will crash more than 45%.

Companies and start ups

Companies will have hard time, too. Now they have to work hard making their product more valuable than it is because now everyone is holding onto cash and nobody is spending money then how will they sell their products. If you want strategy on how you can make your business run better in recession them reach me out on email: admin@hninstructing.com. Startups will suffer most than an established business because people hate to take risks and they want something stable, and they get it from established businesses.

That doesn’t mean that businesses will end in recession. There is more in them. Read along.

Opportunities in next recession

Anyone who invests doesn’t matter who he is or what he does, he will see great opportunities to invest. If he invests during this time, he could make returns up to 50% in matter of months. IF he does analysis before investing then could possibly make 100% return on investments. To learn this visit: Courses. If you are having hard time and want your company to survive then find investors, they will help you out. You can’t hold all the card, you need to give up something to stay in the game.

When is market crash?

Recession because of debt ceiling

As on date 24/05/2023, Fed only has $60 billion left which will only last about Friday and They are going to decide new debt ceiling on June 1. Does that mean that they are going to run out of cash and do default on their debt? Yes, this isn’t their first default, they have done it in past and even in Vietnam war. We can’t say that they can’t hang on 6 days on $60 billion until deciding new debt ceiling. Then they won’t default. They can print as money as they want.

But problem doesn’t stop here. If they default then it would damage US reputation and would affect its credit score as it would be hard to get new debt. This could result into market crash and it will happen sooner than expected. The other way around, if they print money and cut rates then market would crash, too. Which again sooner than expected. They want to hold every card and stop recession.

What if they succeed?

If everything goes right and they somehow manage to hold till June 1 and find new debt ceiling then they won’t have to cut rates and print money as they will get back to original plan to get inflation down to 2% using terminal interest rate. But that won’t succeed. They have hold onto 5.25% interest rate after achieving that and there is not a specific time frame as inflation would get down within certain period,

it could take anywhere from two months to more than a year. If they hold on more than a year or near about then most Americans will become homeless. Before they hold onto that terminal interest rate for certain period, something will break and that will be real estate market.

What will cause this market crash?

Stock market is highly volatile but hard to crash because market look at long term as what will happen. It could go down for one day as much as $1000 and get back up in next days. But real estate market is not like that. If it crashes then its like sink hole, it will take down everything with it. If stock market crashes, then people will lose money and if real estate market crashes, then everyone loses money. And this is what going to happen in next quarter of 2023 (third quarter). I already warned this on my twitter account about biggest crash: Follow for updates and also wrote about it: Follow for more. And you get guide on how you can become financially independent for ZERO cost.

What can do about recession?

If you haven’t got this yet, then its fine. This is time when you can make most money as so many opportunities come at very low price, and you don’t want to lose them. Make sure you get best out this and you do this by owning this course: https://hninstructing.com/product/investing-program-never-buying-liabilities-again/