Wealth is something that everyone wants to build to a massive empire. Even though everyone wants it that doesn’t mean they can do it. You building great wealth is depended on how you manage your personal and business finances. If you believe that you will learn along the way, then you are missing out on so much. As mistake effects compound over time and looking at 30 year later, if you lose $100k today will be worth lot more than in future. That doesn’t mean you are not allowed to make any mistakes. You can, but it should be calculated and that is why you need this guide. You will get lot more out of this and thank yourself for reading this.

Assets to grow

When you are in early stages of your journey or ask someone who is old and has made lot of money for example, Warren Buffet that what is something that will help me build my wealth? And most typical answer you would get is to invest in assets. Assets are only way to go. So, before you start going out there and begin investing in anything, you must need to know that there are major differences between assets and stuffs that look like “assets”. Because if you invest in stuff that look like “asset” then you are fucking up with your journey. If you continue doing this again and again then you will go bankrupt.

Some stuff can be represented as “asset”

Thing with stuff that may look like asset to you while they are not or may present themselves as golden opportunity to invest in as great asset, if you don’t analyze them before investing then you are taking a huge risk. Most of times they end being liability. The rule you have to keep up your life is “buy assets and sell liabilities”. You must be able to distinguish between assets and liabilities. Before you understand what difference is, you need to know what asset and liability truly is. Because when you go and search for those terms on internet, you will be thrown “mainstream” definition which is to keep you away from real truth.

What is asset and liability?

If you look at mainstream definition, then Asset is something you own, and liability is something that you owe. What you have to know that this is bullshit. If you follow this definition, then you will get away from your goal with every single step.

You need new definition to help you. Asset is something that money in your wallet and liability is something that takes money out of your wallet.

Why you needed new definitions?

If you were to continue on using old definitions then you would end up buying liability every time, maybe most time. Because you want to build wealth and you to build that wealth you need “stuff” that will help you to build it. If you followed old definition, then you would not be able to find out what is assets. They are distractions for beginners who have just begun this journey and want to put you into box.

How to distinguish between assets and liabilities?

Now you know better and working definition to build your wealth, it should be clear that how you can distinguish between asset and liability. If you still need assistance, working with examples will help you to clear that.

Example led by mainstream definition

Imagine you were to buy your dream car with your own money. Now you bought it, for personal use obviously. There are two different ways you can classify your new dream car according to different definitions.

First, we will use mainstream definition. So, you bought a new car with your money. No financing, all cash. Now you paid full price means you do not owe anyone anything of that car. It means that it is your asset because you own it.

Example led by our improved definition

Now let’s look at it from our very own definition. You bought a car, paid in full. It’s for personal use. Now you use that car and put fuel in it. Putting fuel and maintaining the car condition are your expenses. Since you are spending your time and money behind a car then you should get something in return, maybe money. But in return you do not get anything. Instead, car value declines every single day from day you drove it out of dealership. There are lot of things wrong here. If you still haven’t got it, then let me simply for you.

Why it is bad?

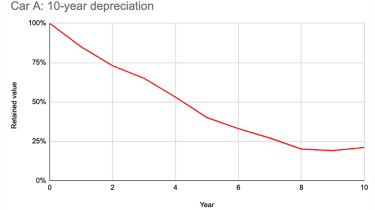

You bought a car: money has been spent. You are putting fuel in car: money keeps spending. You are maintaining car: money keeps spending. You are driving car or don’t even drive it, let it sit: car value declines every moment as you can see in graph. Car has been taking money out of your wallet every single day. And in return, you do not get anything. There is no ROI (return on investment).

From our definition, anything that pulls money out of your wallet and do not give anything in return then it is your liability. Your liability (car) has been taking money and not giving anything in return then how can you say that it is an asset. That is why we do not follow mainstream definitions. Higher price of car, bigger the liability is. It’s up to you what you have to do.

Now if you want to learn even more because this is just a tip of an iceberg. And I will show truth behind all this for free. All you have to do is fill out the form below and you will get my very own personally created eBook on how you can begin your financial journey and become rich. Everything is for free. I do not want you to destroy your future by following mainstream media definitions. There is lot to learn, and this guide is for you.

Enter your name and email address and you will get guide.