Fed was rising interest rates for almost two years. Sometimes taking break, sometimes easing off but rates are still on rise. This has made economy to struggle. And what else is struggling, people like you and me. For example, you invest in real estate, and you want to take mortgage on your next investment property, but interest rates are high, and you can’t afford to pay that much interest. But this is going to change now. Read along to find it out.

Table of Contents

How rising interest rates made it difficult?

Since Fed was raising interest rate, this made difficult for money to flow in system. Money that was moving n system now costed most because of interest rates rising. If interest rate is at 0%, bank get direct money from government at no more cost and then lend them to people at 2%. Since interest rates were rising, banks would get money at higher interest rates and have to add their margins, so they make profit, so getting loans from bank became expensive because you are paying more interest, more money when interest rate is higher. This made money to flow in economy difficult, expensive.

For example, interest rate is at 2% for 30-year mortgage. This means you buy house of $300k then you have to pay 2% interest on that. Here hypothetically you put 0% down payment and have good credit history. Your monthly payment comes to $1372. Interest you pay on that property out of loan amount is $99,189. The cost of house comes down to $399,189. Almost $400,000 at 2% interest rates.

If same house you buy where nothing has changes as its still at $300,000 and everything is same, but mortgage rate is at 6% for 30-year mortgage. Your monthly payment comes down to $1798. And total interest you paid on that property out of loan amount is $347,515. Your cost of house comes to $647,515. Almost $650,000 and taxes are not included.

Because of higher interest rates, you are paying $500 more on that same property. And overall cost of house goes more than double of original price. This is a rip off. You are paying trice the price for same property.

Why buyers are holding on same as you

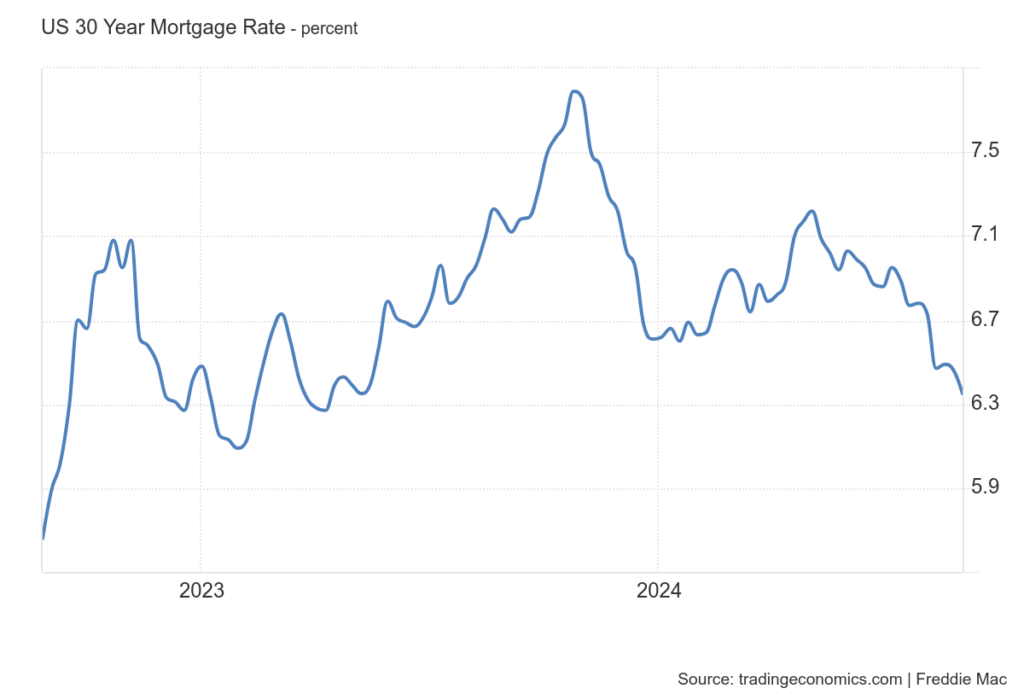

Now you understand why interest rates are critical and you don’t want to buy property at higher interest rates. It is same reason why house buyers are holding on to buy house. You don’t want to pay twice the price for house when you can have it for half price aka original price when interest rates go down. So, you decide to wait till interest rates goes down and economy becomes normal again. Instead of buying house, you rent a house for few months and hold onto your money as interest rates get lower and you grab on that opportunity. The graph of mortgage rates you can see below.

But there are new buyers in every generation. As kids grow, they get married and now they need home. They can’t live in their parents’ home. As population is increasing, there needs to new homes for them to buy and live in. But we have to seem to fall behind that because house inventory was all time low in history of it.

What is house inventory

When new generation grow up, they now need new homes. So whole new generation of country want new homes and how many homes are there for them to buy, those homes are counted in inventory. If hose inventory is low, then its bad and will cause prices of houses to rise and probably form a bubble. You don’t want to pay extra price for property that costs so much more than original.

If house inventory is too high ten there are empty houses that nobody wants to buy because everyone already got home. And those empty properties are just going to degrade and go wasted. If there is too much inventory, then it will cause your property value to decline because buyer can buy it cheaper not you but there. So, you don’t want too much house inventory or loo less. It’s about balance too meet house requirements that people need.

Current situation of housing market

Interest rate is at 6.35%. And it is going to rise by 0.25% in next meeting of Fed. people who had bought the house in beginning when interest rates were low, as you can see in the graph below, they bought it near 2 to 3% fixed interest rates. And they are locked in that 30-year mortgage.

They don’t want to sell their current house and go and buy a new house or property at higher interest rates when they already have house at lowest interest rates possible. They are paying lowest interest on their properties than any other people who bought at higher interest rates. There are only people who are selling properties who don’t have low-interest rate mortgage. Because interest rates are high, it increases properties’ prices as sellers don’t want to sell.

Because interest rates are high, buyers don’t want to go and buy any new property right now. Because you already know that they could end up paying more than twice the original price of that property.

Now we are in situation where sellers don’t want to sell and buyers don’t want to buy. They both are holding on. There are sellers who want to sell because supply is low, so they increase their prices. So how the government is going to solve this situation?

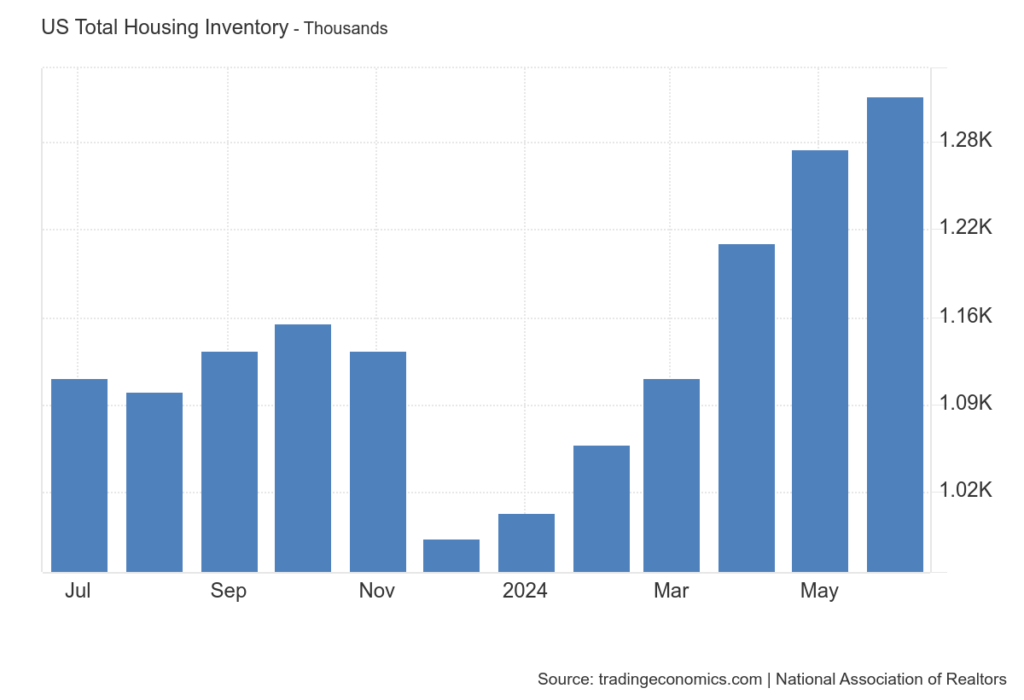

House inventory is rising

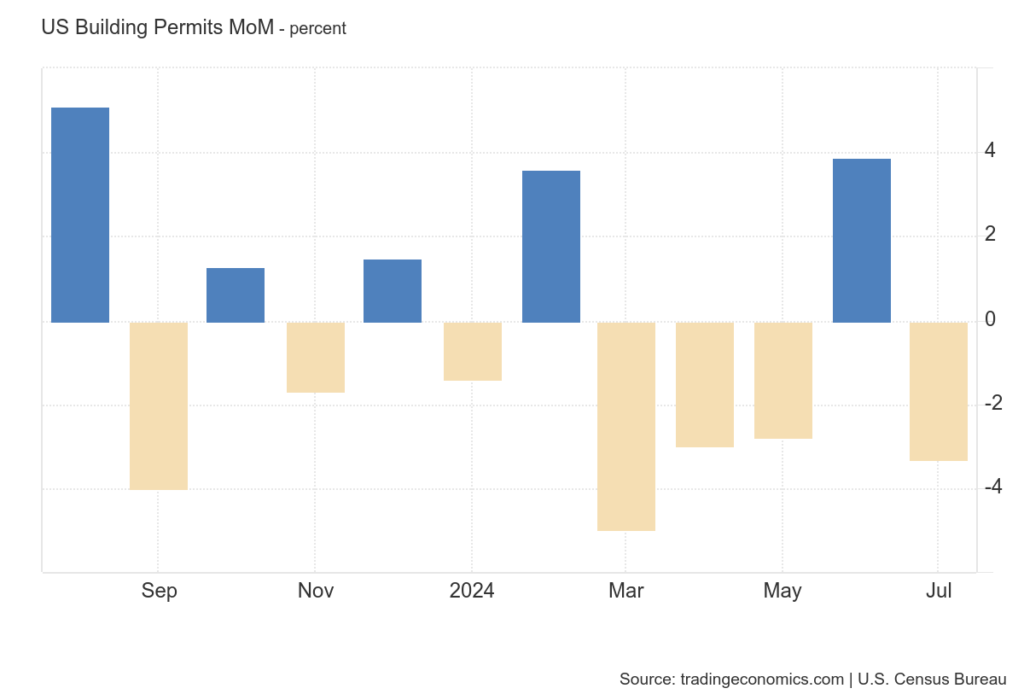

There are more houses built every moth from beginning of 2024. This all began when we had lowest housing inventory of all time in December of 2023, government began to give permit to build more houses to builders and associates. It is to help boost house inventory and ease of the tension in housing market. As you can see in graph.

But this is not only enough to flood the housing market as you will “For Sale” sign in front of every fifth house. It’s not enough to satisfy enough buyers. It’s not going to do that much as only building houses is not going to flood inventory. There’s more.

Lagging index it is

Don’t forget that these all are lagging indices. What is lagging index? It is index that doesn’t give us real time data. Something that has done in past or work began on that in past and we are seeing its result now.

As they began to allow permits for building new homes in beginning of 2024 because we hit all time low on house inventory in December of 2023. As you can see in graph below.

It takes months to build houses, construction takes time. So, constructions that began in start of this year are finishing now and ready to move in. So, we are behind the real time data. As we didn’t see changes in months because of constructions take times and now sudden rise is there.

What all this means?

We don’t have real time data. House inventory is not all time low but its lower than average. We have sudden rise in inventory now. So now some of buyers are satisfies because of new construction permits allowed by government. But this is not going to flood the economy.

When will we see flood in house inventory?

Mortgage rate gets about 4% is when we will see flood in housing market. At that point, people who held on because they had lower mortgage rate will be ready to sell to buyers who were waiting till mortgage rate to get lower. And those who sold because interest rates got lower, the only reason they sold because now they could buy new home at same mortgage rate. This is point where will see flood in housing market.

What if it doesn’t go that way and go wrong?

Fed’s original plan was to get inflation at 2% and hold on. They will hold on till inflation lowers it by itself. They do it through holding same interest rates till inflation lowers itself. If Fed’s still sticking to their original plan of keeping same interest rates till inflation goes down to 2% works, there’s a possibility that economy still would be in turmoil Cause inflation will be at 2%, only on paper. Now inflation is low than peak, but prices are still high. You are paying higher prices for groceries than you used.

If it doesn’t go the way they wanted to then we will see a massive recession that unfolds.

Now you want to make an enormous wealth then read this.

Now how Warren Buffet was wrong about Crypto Currency and to know more then read this.