2023: Real estate bubble exists and you need to know more. Things are tough and hard time is ahead as possibility of recession seems increasing day after day. Even though Fed is planning to control inflation and do soft landing, I hate to break it down to you as we are in bubble and its of real estate and its bigger than 2008. This should sound scary to you because you know what happened in 2008 crash, people lost their savings and everything. You might have lost money, too and it seems like its happening again.

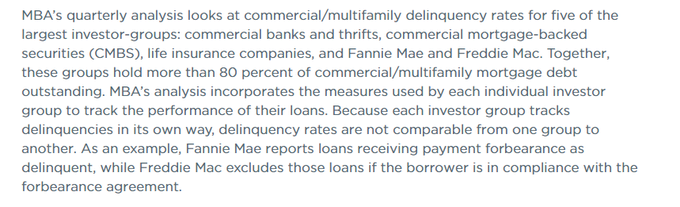

Update from MBA Mortgage as delinquency rate of commercial and multifamily homes has increased and these fives groups are late on 80% of their mortgages.

And we might see defaults soon.

How can we say that we are in bubble and why I am so sure?

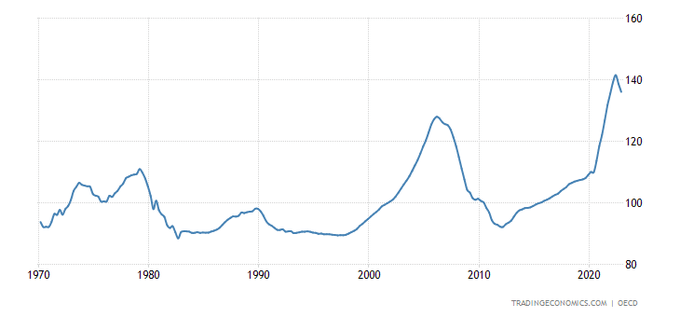

The main indicator is house affordability, We are at historically low of house affordability. This means prices are so high that normal people can not even afford houses. The worst bubble we can be is in real estate because you know what happened in 2008. If real estate goes down then it takes everything with it, its like sink hole.

When house affordability is high means price of homes are high and its bad for investors as they have to pay higher price because of bubble. It is rentals market and they are winning. When they are winning, investors don’t step in market. Investor want this graph flipped because they everything would be in his favor.

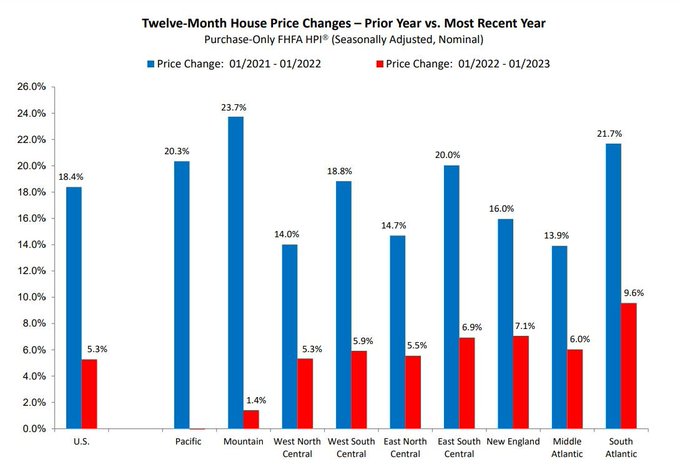

The price is higher than 2008 and its bad news. But we still saw price rise on year over year and this boosted bubble in the air.

In the graph, you can see that we saw steep rise in real estate price hike after 2020. It was steeper than 2007 as it began to rise slowly after 2000.

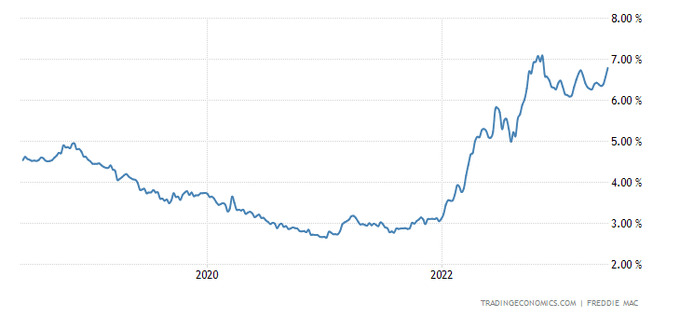

If everything goes right according to Jerome Powell’s plan which is hard to see because you can read it here: Soft landing not possible! If fortune is with us then people are still going to lose money. Now interest rates are high so whoever got loan at higher interest rate, when Federal Reserve will lower interest rates, they all are going to lose money. They will lose money from paying thousands of dollars on interest and by buying things when they are most expensive and paying more than they should.

What to do if you still want to get in market?

If you do find good deal, and make sure its financed at 3%. Then you don’t buy it as financing it with new mortgage, you will get it around 7%. Instead, transfer that existing mortgage at rate of 3% form previous owner and you will save thousands of dollars. Want to lean more: Follow for more.

What we might see in future?

If you look at it from 10,000 foot away, you will see that real estate market is driven by emotions. Even though we are in real estate bubble, we still see price going higher. Because people are here and they want place to live and it doesn’t matter when prices are high but people are still spending money. Even NAREIT have raised $14 billion capital for real estate investing in Q1 of 2023. But they are on conservative side this time.

How bubble is created in real estate market?

Home prices go up. But to not create bubble, there have to backups as prices are not only going up because of hype and stay hollow. The backups are rents and investor market. If prices are going up means rents should go up and since rents are high means people aka investors are ready to put more money in.

In 2023, bubble is already created and rents are not following it. Its rentals market and investors won’t get into that. Home prices are went up and investor market can not keep up. With Jerome Powell’s plan, we might see hard things in future.