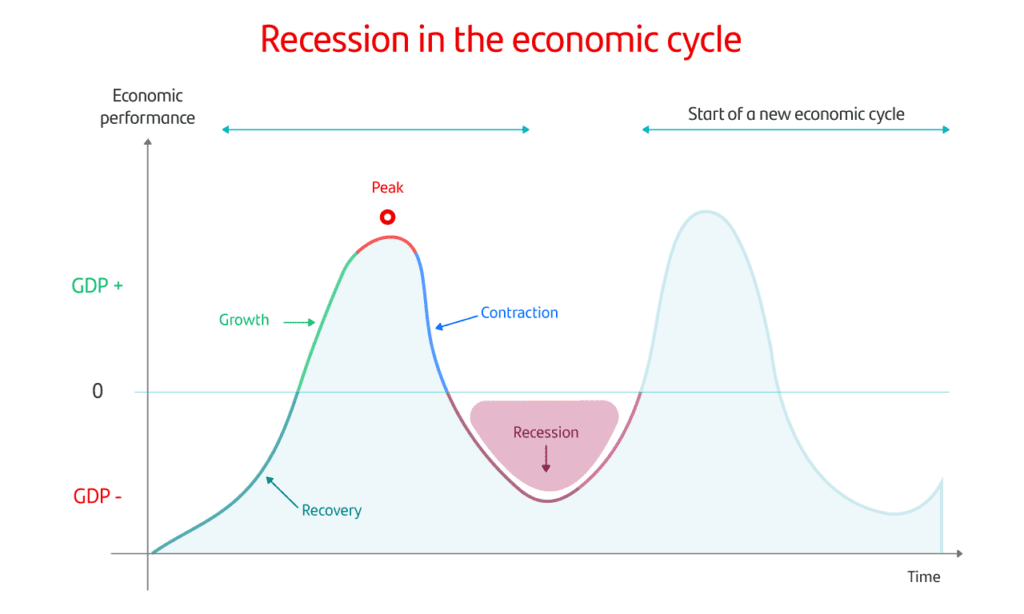

We are heading towards biggest recession in history, even bigger than 1929 market crash where Us stock market fell 89% from its peak and Black Monday. This recession will be biggest because it is going to take everything with it as black hole.

How it could be biggest recession?

When stock market crashes, people start to withdraw money from every possible thing. From where they withdraw money, matters the most. They will withdraw money from certain places and it is determined by things that happen before market crash. This will include inflation, which assets are overpriced, assets with high or low liquidity.

People with low financial intelligence, they do consider their house as their biggest asset. Truth is, its not. Inflation has made them blind and that is why they can’t see that their house is overvalued. When deflation comes, then only those people can see true picture and this would cause them a lot. This will decrease their wealth in tremendous percentage, because they think their house is biggest asset.

Federal Reserve said in recent speech as inflation is at 9.1% and it is transitory and they will hike interest rates, but they are lying to us. Actual inflation is seen in retail market from where most of revenue of government comes aka GDP. Truth is that inflation is at 16% and it is not transitory. If it is transitory then why you are seeking for big hike in interest rates. When they said, “its transitory.” Most people believed it and didn’t see the truth. And on that day, US stock market closed positive.

People invest in real estate and consider it as their biggest asset. It can be biggest asset, if it is producing passive income. To learn how to start making passive income with no money then visit our product on: Investing Program – Never buying liabilities again – hninstructing.com Get direct training for investing by Harsh Nandanwar. This program will include learn how to save taxes? How to make money work for yourself? How to start in life? How to become financially independent? Strategies and techniques for investing, how to analyze deals? How to make sure always buy assets? How to turn liabilities into This course is helpful in becoming financially free. So, people do forget that real estate market has low liquidity as compared to other asset classes. When market crashes, people sell every possible asset they have to save themselves from loss cover remaining amount as much as possible.

But when people start to sell real estate, it starts to take everything with it as overall market value of each assets class decreases. Cities’ prices go down. With it, inflation rates suddenly go down.

If you like this, then please visit out other articles on: Blog – hninstructing.com. This helps us to grow and do share it.

-

You are writing your ads the wrong way: Common ads mistakes

Writing good advertisement is the goal to get more engagement for advertising so people will buy more of your products. There are common ads mistakes. To sell your products, you don’t want to write bad advertisements. There are huge Ad-Agencies who make mistakes and write bad advertising. You don’t want to such mistakes. And how…

-

How to make ad will guarantee to get more viewers & engagements

Headlines are most important thing in an advertisement. It can make or break your advertisement. It doesn’t matter how good your body copy is. If your advertisement’s headline doesn’t sell, then good luck with spending millions on your body copy and it still wouldn’t sell your products or services or attract customers. Why does your…

-

House Inventory: Housing Market is Going to Flood with Houses

Fed was rising interest rates for almost two years. Sometimes taking break, sometimes easing off but rates are still on rise. This has made economy to struggle. And what else is struggling, people like you and me. For example, you invest in real estate, and you want to take mortgage on your next investment property,…